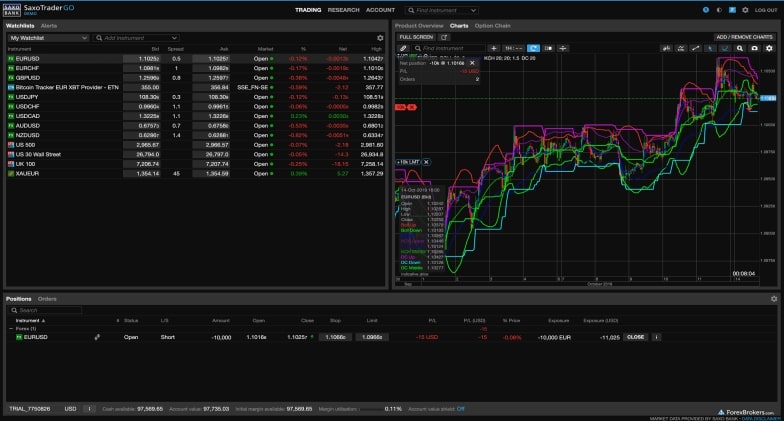

We’ll take a look at the basics of Saxo Bank’s trading platform in this Saxo Bank review. It also includes an economic calendar and news feed. While it doesn’t offer live chat, users can chat with a chatbot. The bank’s website also features a “Inspiration” menu with daily commentaries, long-term outlook pieces, and additional news and analysis.

Low Minimum Deposit Requirement

You can deposit funds to your Saxo account with a credit card or debit card. However, you may need to pay a transaction fee when doing so. You can also deposit funds with the bank by wire transfer, although withdrawals can take up to three business days. In our saxo bank review, we’ll look at some of the positive features and cons of using this bank.

One of the major benefits of using Saxo Bank’s services is their low minimum deposit requirement. You can also benefit from their world-class industry expertise at a fraction of the cost of a traditional wealth manager. Another advantage of using this bank is the lack of a lock-in period. Whether you prefer a desktop version or a mobile app, you’ll find everything you need to make an informed decision about this online broker.

Factors Before Choosing The Best Forex Broker In India

You should consider the features and services of the broker, including its trading platforms, spreads, and commissions. A good forex broker in India offers a demo account that you can use to learn how to use their platforms. Some brokers also provide educational resources like blogs and tutorials, so that you can learn new features before you spend real money. You should also be aware of how they handle customer support, as this will help you make the best decision for your needs. A few other things to keep in mind when choosing a best forex broker in India are: India’s Securities and Exchange Board (SEBI) regulates the forex market, so make sure that you select a firm that is regulated by the SEBI.

While the United Arab Emirates has a stable currency, the UAE’s currency is a pegged currency to the US dollar. Pegged currencies aren’t particularly attractive Forex assets because they follow the same trajectory of price movement as their primary currency. This means that the United Arab Emirates dirham would be influenced by USD price movements on a regular basis. As such, it would be a poor investment. A broker that offers such a leverage is not necessarily the best option.

Its goal is to protect traders by ensuring that brokerage companies adhere to the highest standards of transparency and fairness. The central bank of the UAE also has a Consumer Protection Department, which monitors complaints and investigates problems with CBUAE regulated brokers. These organizations also help consumers protect themselves from financial complications.

Conclusion

OctaFx is a public trading company in the United Kingdom that has earned a four-star these brokers also offer sign-up bonuses and referral schemes to attract new traders. SEBI has strict rules for Forex brokers in India to protect investors and protect the Indian economy. The country has a currency futures and options market since 2008.