Do you know what happened to the one-month Hibor, or Hong Kong Interbank Offered Rate? Let’s find out!

Interestingly, In a month, the standard cost of borrowing rate tripled as Hong Kong’s de-facto national bank depleted money at a historic rate to the local currency’s fragility.

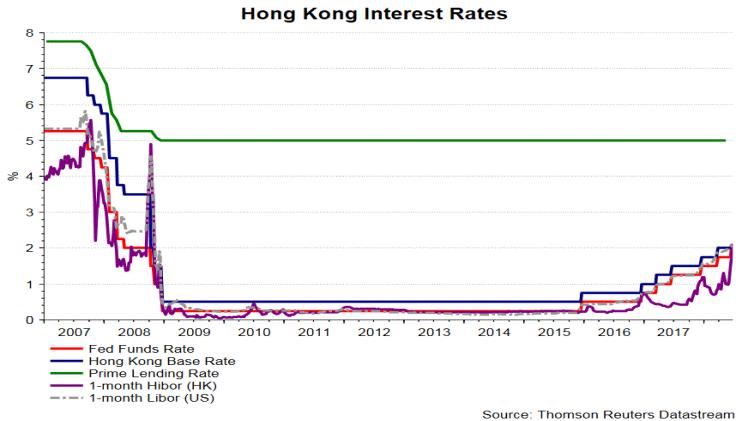

The one-month Hong Kong Interbank Offered Rate jumped a month before, to 0.83 percent from 0.19 percent. The surge resulted from vigorous domestic currency acquisitions by the Monetary Authority of Hong Kong in order to prevent the regional money from declining past the low point of its trading session of 7.76 to 7.86 per greenback. What’s interesting is that the action was taken in an effort to limit outflows by the city’s interest-rate difference compared to the U.S.

Carie Li from DBS Bank Ltd stated that “If the interbank credit base continues to contract due to involvement, we can see more gains for the Hibor in December and September demand, Li said. Carie Li predicts that the single-month rate will reach a double year 1.8 percent at the end of September and 2.29% by the end of the following year.

The Hong Kong Monetary Authority’s operations have lowered the In less than a double week, the total balance, a measure of the intermediary money stock, increased by nearly 31% to HK$232.4 billion ($29.75 billion). The single-month hibor jumped to a 2-year peak this week, although it still yet lags the US equal by 81 basis points.

According to analysts, the Hong Kong Monetary Authority may need to spend nearly $16 billion countering Hong Kons a peg whenever the dollar increase in the U.S. rate hikes. The Hong Kong Monetary Authority has spent about $12.9 billion since May.

Hong Kong and the Federal Reserve

Hong Kong buys the, U.S. Federal Reserve’s monetary policy as a result of the currency’s linkage to the U.S. currency, its benchmark rates haven’t rose rapidly enough to surpass with U.S. borrowing costs.

Notably, that provides hedge funds a profitable trading option, which can obtain the local currency inexpensively and trade the local currency compared to the more lucrative U.S. currency. It indicates that the Hong Kong Monetary Authority is required to continuously removing currency from circulation in order to promote the domestic rate of exchange.

There are many brokers, and it is impossible to know everything about brokers. Moreover, it takes time to gather interesting details about forex. If you are simply interested in brokers or you plan to enter the forex market, it makes sense to read the Stocklinity review.

Notably, a persistent rise in the single month Hibor, the benchmark rate for the city state’s loans for homes, maybe create another risk factor for the local economy that is Constraints placed by Covid are already causing disruptions. Hong Kong’s government revised its estimated growth in the economy to a level of 1.1% to 2.1% for the year. The government downgraded its forecast even though banks such as the Goldman Sachs Group Inc see and growth of 0.29

DBS Bank Ltd isn’t alone in projecting future rises in Hibor. For example, BOAC predicts the monthly rate to reach 1.9% by the end of October and 2.6% by the last of the year.